How much can i borrow with 50000 deposit

Shows how long youd need to save for a deposit depending on the price of the property and percentage of its value you need to put down. Simple Secure Online Application.

How To Access Equity Remortgaging For A Cash Lump Sum

As part of an.

. How much can I borrow with a 50000 deposit. IStock Whether youre financing a major. Ad Rates From 249 Fixed APR With Loans From 1000 to 100000.

On a 50000 salary before tax you can borrow between 200000 and 350000 for the purpose of purchasing a property to live in to be repaid over a 30 years loan term. However the Compare Home Loans table. As a general rule home buyers will need 5 to 10 of the purchase price of the house as a deposit.

Loan must be funded by 30 April 2023. 50000 annual gross income at 30. The amount of money you can borrow with a 50000 deposit depends on the propertys purchase price.

Heres how a difference in your assumed property price and lender valuation can affect the deposit you need. Instant Cash in 5 Minutes. Ad Compare Mortgage Lenders.

See How Much You Can Save. However lenders will generally not let you borrow more than 90 of a propertys value. Or 400000 x 10100 40000.

How much can I borrow with a. Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances 5 Deposit Calculation for a. In most cases a lender wont give you a home loan thats more than 90 of.

Up to 95 of the property value using a personal loan as a deposit. When you apply for a mortgage lenders calculate how much theyll lend. 100k deposit 500k assumed price 02 x100 for a percentage 20.

Personal loans up to 50000 with low fixed rates that will never change. Ad 100 - 5000 Instant Cash. A 50000 loan can be used for anything from financing a major purchase to funding a home renovation.

Find out how much you could borrow Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Best 50000 Loan Rates Reliable Comparison Reviews Best Rates Quick Approval. Or 2 How much you can borrow or 3 what your total monthly payment.

For example if you take out a 50000 loan for one. For example if your gross salary is 80000 the maximum mortgage would be 280000. The amount of money you can borrow with a 50000 deposit depends on the propertys purchase price.

Or by using our awesome deposit. You can calculate this manually by getting the purchase price and multiplying it by the deposit amount divided by 100. But ultimately its down to the individual lender to decide.

For example a first-time buyer earning 25000 with a 50000 deposit can borrow up to a maximum of 154000 with HSBC but only 111250 with Santander. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You.

Apply And See Todays Great Rates From These Online Mortgage Lenders. Your salary will have. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Variable you would make 180 monthly payments of 49913 and pay 8984340 overall which includes interest of. The size of your deposit will make a. To qualify for the maximum amount single homeowners can have assets of up to 270500 while non.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. 100k deposit 500k assumed price 02 x100 for a percentage 20. Ad Low Interest Loans.

If youre looking to maximise how much you can borrow however a larger deposit can go a long way. As part of an. Compare Low Interest Personal Loans Up to 50000.

Compare Interest Rates And Repayments. Find The Right Mortgage For You By Shopping Multiple Lenders. For example a first-time buyer earning 25000 with a 50000 deposit can borrow up to a maximum of 154000 with HSBC but only 111250 with Santander.

A 400000 loan amount variable fixed principal and interest PI home loans with an LVR loan-to-value ratio of at least 80. For borrowings up to 90 including lenders mortgage insurance of the property value. 100k deposit 500k assumed price 02 x100 for a percentage 20.

For this reason our calculator uses your. If you borrowed 46000 over a 15-year term at 840 pa. The monthly payment on a 50000 loan ranges from 683 to 5023 depending on the APR and how long the loan lasts.

Get an Online Quote in Minutes. If youve been able to save a large deposit to buy a home a lender will likely lend you more. How much can I borrow.

Heres how to get one. We calculate this based on a simple income multiple but in reality its much more complex.

Compound Interest Calculator Daily Monthly Quarterly Annual

Credit Score Your Number Determines Your Cost To Borrow

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

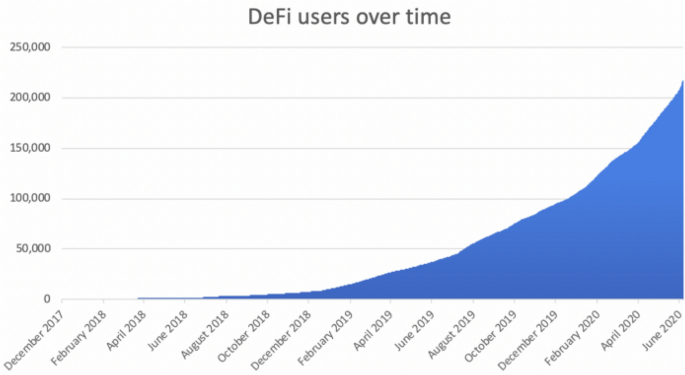

10 Best Defi Coins To Invest In 2022 News And Price Charts Zipmex

Here S How To Finance Your Remodel This Old House

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

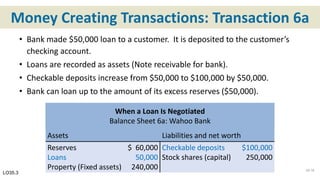

Econ606 Chapter 35 2020

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Nexo Fixed Term Deposits Explained Nexo

You Deposit 2 000 Each Year Into An Account Earning 8 Interest Compounded Annually How Much Will You Have In The Account In 25 Years Quora

10 Best Defi Coins To Invest In 2022 News And Price Charts Zipmex

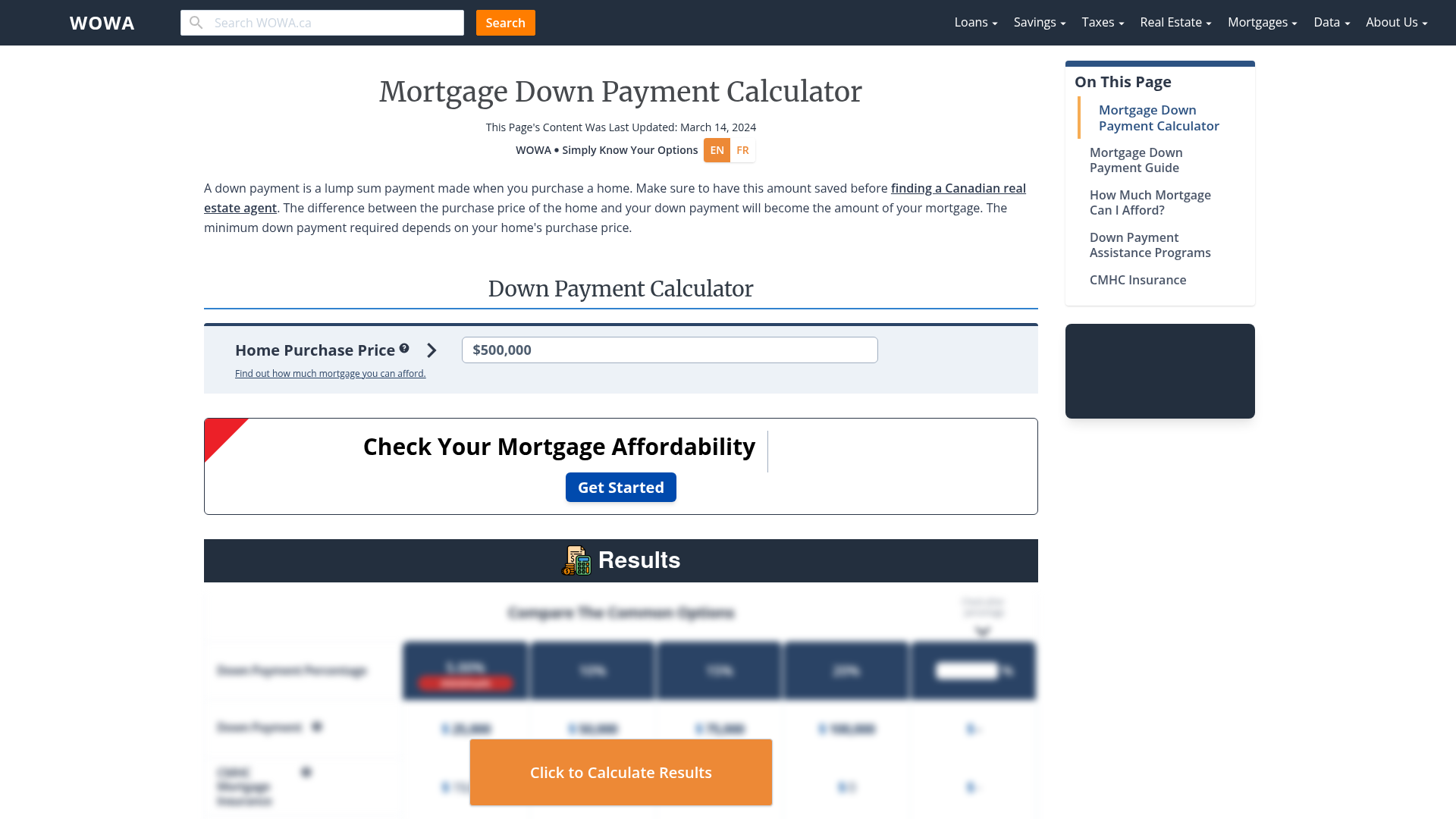

Mortgage Down Payment Calculator Ratehub Ca

How To Borrow Against Your Life Insurance Policy Valuepenguin

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Compound Interest Calculator Daily Monthly Quarterly Annual

Qtrade Review 2022 Pros And Cons Uncovered

Decentralized Finance Research And Developments Around The World Springerlink